The Municipal Government Act (MGA) regulates the collection of development levies in Alberta. An off-site levy bylaw, crafted and approved in accordance with the MGA, enables the Municipality to collect funds through development levies to fund costs of facilities, infrastructure, and transportation infrastructure needed to support growth. The Town of Canmore off-site levy methodology includes:

- Master planning to determine facilities, infrastructure, and transportation infrastructure required to support growth;

- A method of determining the levies associated with the bylaw; and

- A description of how costs incurred by the Town of Canmore in providing facilities, infrastructure, and transportation infrastructure are to be collected from the development community.

This is necessary because the Town of Canmore often needs to pay for large growth-related facilities, infrastructure, and transportation infrastructure projects much earlier than the development occurs. In contrast, the off-site levies are paid by developers as installments over time based on actual units developed. This creates a long term, financially binding relationship between the Town of Canmore (Town) and the development community and as such, requires a consistent, fair, and transparent approach.

The basic premise of an off-site levy bylaw is that facilities, infrastructure, and transportation infrastructure costs within the planning horizon are apportioned to development occurring within that same horizon; that existing development does not pay for facilities, infrastructure, and transportation infrastructure within a future horizon (subject to residual benefits), and that future development does not pay for past facilities, infrastructure, or transportation infrastructure outside of the planning horizon.

Off-site levies cannot include facilities, infrastructure, or transportation infrastructure that was built prior to the planning horizon in the levy, even though that facility, infrastructure, or transportation infrastructure often benefits new development. For example, while new development may increase wear and tear on existing transportation infrastructure, recreation facilities, or a water pump station, there is no mechanism within the MGA for a municipality to capture either this benefit, or the related lifecycle and maintenance costs even though growth related development may erode quality of service or reduce service lifetime. These costs are borne by ratepayers and taxpayers, regardless of the benefit provided to growth related development.

Off-site levies enable the Town to:

- Plan for growth in alignment with the Town’s statutory documents including Municipal Development Plans, Area Structure Plans, and Area Redevelopment Plans; and approved growth-related master plans.

- Provide facilities, infrastructure, and transportation infrastructure required to support a growing community.

- Ensure basic needs of new neighbourhoods and developments are met.

- Build required facilities, infrastructure, and transportation infrastructure when it is needed.

The methodology used by the Town to develop the off-site levy rates is described below.

- engaging industry representatives earlier and more substantially in the development of the Utility Master Plan;

- including information on growth attribution and benefit for each project in the Utility Master Plan to increase transparency and opportunity for engagement on the topic with industry representatives;

- improved the accuracy of service demand factors (explained in more detail later in this section); and

- presenting annual reporting to include offsite levy information in a stand-alone document.

The fundamental approach of identifying the growth-related share of facilities, infrastructure, and transportation infrastructure costs and determining a levy based on an attribution of those costs remains unchanged. Application of the methodology consistently across the community (for that type of infrastructure, facility or transportation infrastructure) ensures that growth related facilities, infrastructure, and transportation infrastructure costs are appropriately funded by levies.

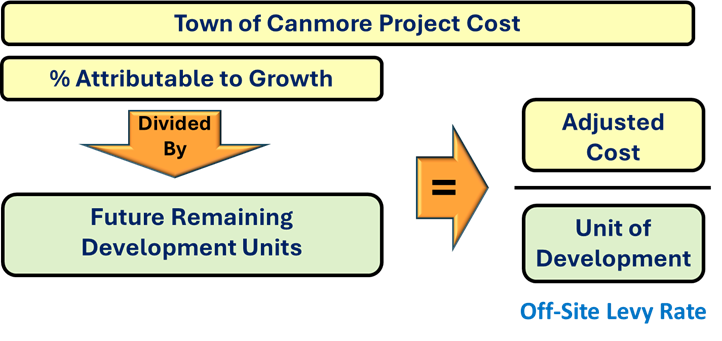

A very basic representation of how an Off-site Levy Rate is calculated is shown above.

Once projects have been identified, cost estimates are prepared for the capital projects, and costs are allocated to the Town of Canmore and to the Off-site Levy zones according to projected growth.

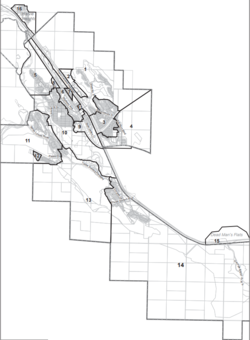

There are two primary considerations for determining who benefits from new or upgraded facilities, infrastructure, and transportation infrastructure and facilities: Benefitting Areas, which are the Off-site Levy Areas which benefit from the project when it is initiated by growth, and Residual Benefits, which assesses the benefits of the project to the existing system / the Town of Canmore. Benefitting areas are the areas or zones of the community that benefit from the facilities, infrastructure, and transportation infrastructure that is required. The map to the left shows the current benefitting areas in Canmore (click to enlarge).

Off-Site Levy Bylaw

You can view the current Off-Site Levy Bylaw here.